2 North Dakota Plan Types

The state of North Dakota offers 2 types of 529 plans for North Dakota residents. North Dakota residents can access and participate in these plans via College Save.

There are Age Based Portfolios, and there are Individual Portfolios.

Residents in the other states also have access to 2 types of plans.

Non North Dakota residents have access to Age Based Advisor Portfolios and Individual Advisor Portfolios.

College Save 529 - Direct | North Dakota residents

Aged Based Portfolios

North Dakota residents have access to 9 Age Based Portfolios.

The asset allocation models are based off the age of the beneficiary. These types of portfolios tend to invest in a more aggressive fashion when the during the early ages and gradually shift to more conservative models as the beneficiary ages. Lets dissect the models.

Each age group has 3 choices for asset allocation models: conservative, moderate or aggressive.

The investor instructs College Save the category they are most comfortable with.

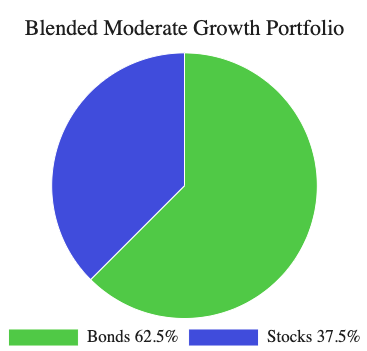

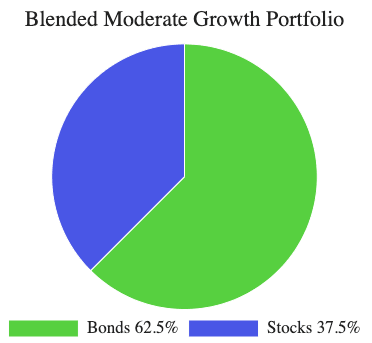

For example, the newborn age group is for individuals that are 4 years old or younger. The investor can choose between a conservative portfolio with an allocation split of 62.5% stocks, 37.5% bonds.

If the investor chooses a more middle of the road approach, then the investor could select the moderate portfolio with a 87.5% allocated in stocks, with 12.5% invested in bonds.

If the investor is more interested in a more aggressive approach, then they could select the aggressive portfolio with 100% stock allocation.

Conservative Models

Moderate Models

Aggressive Models

Ages 0-4

Ages 5-6

Ages 7-8

Ages 9-10

Ages 11-12

Ages 13-14

Ages 15-16

Ages 17-18

Ages 19 and up

As the beneficiary ages, all the portfolios shift towards more conservative investments.

Notice the dramatic shift in the asset allocation models of the portfolios for beneficiaries that are 19 years old and up.

The conservative portfolio is 100% invested in short term reserves, which are typically securities such as money markets, short term bonds and treasury bills, also known as T bills.

The Blended Moderate Growth Portfolio has 75% of the assets invested in bonds, 25% in short term reserves. The Blended Growth portfolio has 87.5% invested in bonds and has some stock exposure of 12.5%.

Individual Portfolios

North Dakota residents also have the option to invest in 6 Individual Portfolios.

This will allow them to choose a single portfolio or a combination of individual portfolios.

There is an Aggressive Growth Portfolio which has 60% of the portfolio invested in the Vangard Institutional Total Stock Market Index Fund and 40% in the Vangard Total International Stock Index Fund. This fund seeks to provide capital appreciation, which is the most aggressive of the 6 Individual Portfolios.

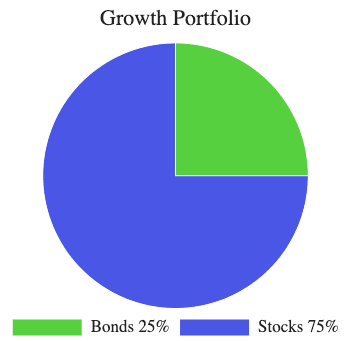

There is the Growth Portfolio which seeks to provide capital appreciation and low to moderate income. This portfolio has 45% of its portfolio invested in the Vangard Institutional Total Stock Market Index Fund. 30% in the Vangard Total International Stock Index Fund, 17.5% invested in Vangard Total Bond Market II Index Fund, and 7.5% invested in the Vangard Total International Bond Index Fund.

The Moderate Growth Portfolio has 35% of the portfolio in the Vangard Total Bond Market II Index Fund. 30% of the portfolio in the Vangard Institutional Total Stock Market Index Fund. 20% in the Vangard Total International Stock Index Fund. 15% in the Vangard Total International Bond Index Fund. This portfolio seeks to provide capital appreciation and current income.

The Conservative Growth Portfolio seeks to provide current income and low to moderate capital appreciation. 52.5% of this portfolio is invested in the Vangard Total Bond Market II Index Fund. 22.5% is invested in the Vangard Total International Bond Index Fund. 15% is invested in the Vangard Institutional Total Stock Market Index Fund. 10% is invested in the Vangard Total International Stock Index Fund.

The Income Portfolio seeks to provide current income. 34.5% of this portfolio is invested in the Vangard Total Bond Market II Index Fund. 25% is invested in the Vangard Short Term Reserves Account. 22.5% is invested in the Vangard Total International Bond Index Fund. 18% is invested in the Vangard Short Term Inflation-Protected Securities Index Fund.

The Interest Accumulation Portfolio seeks to provide income with the preservation of principal. 100% of this portfolio is invested in the Vangard Short Term Reserves Account. This is the most conservative portfolio of the 6 Individual Portfolios.

College Save 529 – Advisor | Non North Dakota residents

Aged Based Portfolios

Non North Dakota residents also have access to 9 Age Based Portfolios.

The asset allocation models are based off the age of the beneficiary.

These types of portfolios tend to invest in a more aggressive fashion when the during the early ages and gradually shift to more conservative models as the beneficiary ages.

Each age group has 3 choices for asset allocation models: conservative, moderate or aggressive. The investor instructs College Save the category they are most comfortable with.

Ages 0-4

Ages 5-6

Ages 7-8

Ages 9-10

Ages 11-12

Ages 13-14

Ages 15-16

Ages 17-18

Ages 19 and up

Individual Advisor Portfolios

Non North Dakota residents also have the option to invest in 6 Individual Advisor Portfolios. This will allow them to choose a single portfolio or a combination of individual portfolios.

There is an Aggressive Growth Portfolio which has 60% of the portfolio invested in the Vangard Institutional Total Stock Market Index Fund and 40% in the Vangard Total International Stock Index Fund. This fund seeks to provide capital appreciation, which is the most aggressive of the 6 Individual Portfolios.

There is the Growth Portfolio which seeks to provide capital appreciation and low to moderate income. This portfolio has 45% of its portfolio invested in the Vangard Institutional Total Stock Market Index Fund. 30% in the Vangard Total International Stock Index Fund, 17.5% invested in Vangard Total Bond Market II Index Fund, and 7.5% invested in the Vangard Total International Bond Index Fund.

The Moderate Growth Portfolio has 35% of the portfolio in the Vangard Total Bond Market II Index Fund. 30% of the portfolio in the Vangard Institutional Total Stock Market Index Fund. 20% in the Vangard Total International Stock Index Fund. 15% in the Vangard Total International Bond Index Fund. This portfolio seeks to provide capital appreciation and current income.

The Conservative Growth Portfolio seeks to provide current income and low to moderate capital appreciation. 52.5% of this portfolio is invested in the Vangard Total Bond Market II Index Fund. 22.5% is invested in the Vangard Total International Bond Index Fund. 15% is invested in the Vangard Institutional Total Stock Market Index Fund. 10% is invested in the Vangard Total International Stock Index Fund.

The Income Portfolio seeks to provide current income. 34.5% of this portfolio is invested in the Vangard Total Bond Market II Index Fund. 25% is invested in the Vangard Short Term Reserves Account. 22.5% is invested in the Vangard Total International Bond Index Fund. 18% is invested in the Vangard Short Term Inflation-Protected Securities Index Fund.

The Interest Accumulation Portfolio seeks to provide income with the preservation of principal. 100% of this portfolio is invested in the Vangard Short Term Reserves Account. This is the most conservative portfolio of the 6 Individual Portfolios.